Global Semiconductor & Electronics Industry Outlook, 2025

An in-depth analysis of key trends, market dynamics, and growth opportunities shaping the Global Semiconductor and Electronics industry in 2025.

Explore High Growth Markets

Author: Swarup Sahu

Introduction to Semiconductors & Electronics Industry

The Semiconductors and Electronics (S&E) industry is a key part of the global digital economy. It powers everything from smartphones and data centers to electric vehicles, healthcare devices, and industrial automation. In 2024, the sector generated over $6.7 trillion in sales, highlighting its important role in driving innovation and global economic growth. The industry's role extends beyond consumer products, driving key capabilities in defense, energy, and global digital connectivity.

Historically, the industry has shown moderate growth in line with the expansion of computing and consumer electronics with semiconductors forming the key foundation of nearly all devices. Over the years, the sector has transformed rapidly, including telecommunications, robotics, and industrial automation. Today, S&E includes much more than chips and circuits; it powers AI, 5G, IoT, and electrification, connecting multiple industries and creating a highly interconnected ecosystem. This progress shows how technological advances, market demand, and strategic investments reshape the industry.

The sector encompasses several key sub sectors including Semiconductors, Electrical and Electronics, Wires and Cables, Telecommunication and Cellular Devices, Robotics, S&E Technology, and other Miscellaneous. Semiconductors drive high-performance computing, AI applications, and data center growth. Robotics is transforming the global manufacturing and industrial processes, allowing for more automation and efficiency. Telecommunication and cellular devices are important to 5G deployment and global connectivity that support everything from smart cities to IoT networks. Together, these key sub sectors develop a strong, innovation-focused system that powers every industry.

Currently, the sector is expanding in a rapid pace. According to Semiconductor Industry Association, Semiconductor sales rose by 19.1% in 2024, reaching USD $627.6 billion and is expected to surpass $1 trillion by 2030. This growth is driven by the rising demand for AI, high-performance computing, data centers, and memory. Companies are investing about $185 billion in capital and increasing manufacturing capacity by 7% to meet this growing demand. At the same time, robotics and industrial automation are growing rapidly driven by increasing manufacturing upgradation, the use of AI, and smart factory projects. However, obstacle such as supply chain disturbance, shortage of skilled labor, rising input costs, and geopolitical pressures continue to challenge the industry, encouraging companies to innovate strategically and operate with resilience.

Looking ahead, the S&E market is set to surpass $9.8 trillion by 2030. Companies that combine innovation with operational strength and use next-generation chips, AI-powered devices, robotics, and smarter manufacturing will not only grow but also influence the pace of global technological progress for years to come.

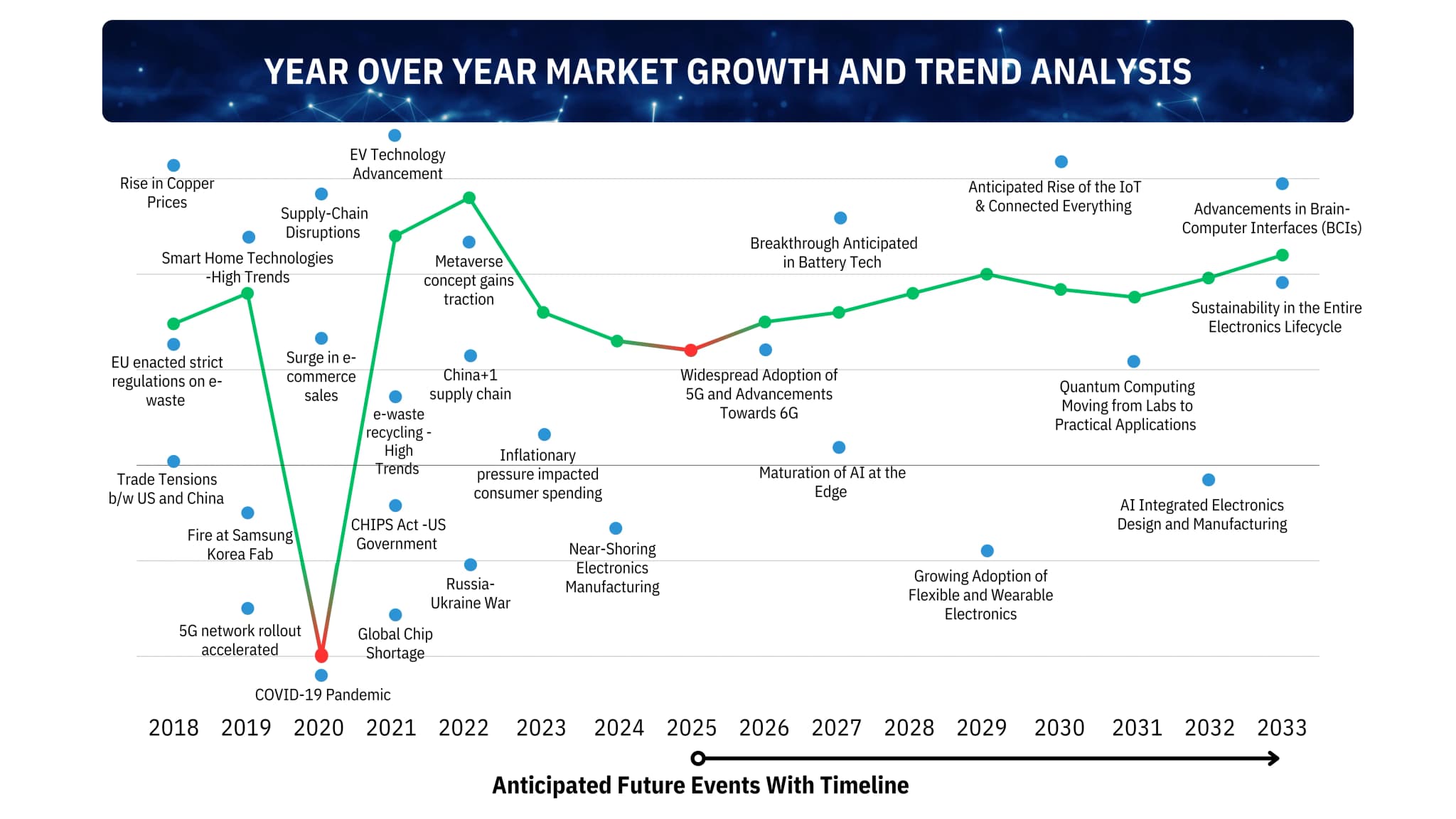

Semiconductors and electronics industry growth pattern showing chip shortage impact, innovation milestones, and market recovery

Market Landscape and Economic Importance

The Semiconductors and Electronics industry plays a crucial role in driving global economic growth. The sector stimulates industrial growth by enabling smart manufacturing, connected systems, and modern consumer electronics, thereby increasing productivity, generating high-value jobs, and supporting overall economic development.

In particular, North America continues to lead the world in research, development, and manufacturing. The United States alone contributes about 45% of global R&D spending in semiconductors, electronics, and robotics, placing the US as a global key hub for R&D. Major companies including Intel, NVIDIA, and Texas Instruments influence tech trends while also investing significantly in local production and workforce training. NVIDIA has committed up to $100 billion in a partnership with OpenAI, the creator of ChatGPT, to improve AI infrastructure. This investment will support the development of at least 10 gigawatts of AI data centers using Nvidia's Vera Rubin platform with the first gigawatt is set to be deployed in the second half of 2026, showcasing the U.S.'s leadership in AI technologies. Moreover, policy initiatives, such as the CHIPS Act, strengthen the U.S. commitment to reliable domestic supply chains, advanced manufacturing, and strategic independence.

Similarly, Europe has established itself as a strong industrial hub. Germany, France, and the Netherlands together account for about 20% of global production in electrical and electronic systems, industrial robotics, and telecommunications equipment. The region continues to expand its capacity, Germany alone installed nearly 26,982 industrial robots in 2022, accounting for nearly 32% of EU installations, as reported by the International Federation of Robotics. Looking ahead, Europe has set a goal to capture 20% of the global semiconductor market by 2030 through the EU Chips Act, which is expected to attract over $50 billion in public and private investment by 2030. As per the European Council, Europe semiconductor market is projected to grow at a rate of about 9.8% annually, reaching over $174.9 billion by 2030. These initiatives strengthen Europe's competitive edge in advanced Semiconductors and Electronics sectors while promoting technological leadership.

In the Asia-Pacific region, semiconductor production is dominated by Taiwan, South Korea, China, and Japan; however, emerging countries such as India, Vietnam, and Indonesia are strategically investing to hold a significant share of semiconductor production. As per our projection over the next 15 years, these regions will secure a combined 10-15% share of global semiconductor production, driven by supportive government policies, targeted investment incentives, and competitive cost structures, positioning them as key players in the evolving global supply chain. For example, India is advancing its semiconductor capabilities through the India Semiconductor Mission (ISM), launched in December 2021 with $9.1 billion in investment, with the ambition of building a self-sustaining ecosystem for fabrication, design, and manufacturing.

Further, Vietnam is emerging as a regional hub with companies like Amkor Technology investing $1.6 billion in a manufacturing, testing, and assembly plant in Bac Ninh province. These developments highlight a larger trend in global semiconductor production. Manufacturers have shifted from traditional centers to new markets with lower costs and strategic benefits. This shift positions India and Southeast Asia as important players in the global Semiconductors and Electronics supply chain.

The Semiconductors and Electronics industry support many high-growth sectors as it powers electric vehicles, autonomous vehicles, industrial automation, medical devices, and renewable energy. By supporting these essential technologies, it boosts productivity, innovation, and competitiveness. The industry establishing itself not just as a component supplier but as a key enabler of global industrial and technological advancement.

Segmentation of Semiconductors & Electronics Industry

The global Semiconductors & Electronics (S&E) industry is a vast interconnected ecosystem that drives modern technology and economic growth. It includes Semiconductors, Electrical & Electronics, Wires & Cables, Telecommunication & Cellular Devices, Robotics, S&E Technology, and S&E Miscellaneous, each serving unique applications and end-user needs. The Semiconductors & Electronics industry demonstrates an active environment which depends on continuous innovation. The different sub-industries within this sector operate with unique growth factors and obstacles yet they unite to establish the fundamental structure of contemporary industrial and digital systems.

The Semiconductors sector functions as the fundamental structure of this ecosystem as it enables operation of smartphones and cloud data centers to electric vehicles and defense systems. The semiconductor industry generated more than $600 billion sales worldwide in 2024 owing to the increasing market requirements for AI technology and high-performance computing and energy-efficient semiconductor solutions. The sector drives worldwide digital transformation through its application in consumer device, automotive systems, telecommunications networks, industrial automation and healthcare sector. The semiconductor value chain extends from design to fabrication and equipment and materials production with Asia dominating manufacturing yet the U.S. and Europe maintaining leadership in design and innovation.

The Electrical & Electronics sector produces over $4 trillion in 2024 through its diverse range of consumer and industrial products which include home appliances, lighting systems and industrial control systems. The sector experiences growth due to the increasing urban development and digital transformation, increasing demand for intelligent connected solutions across the globe. The industry enhances daily life quality through its direct contributions while delivering operational efficiency to business and industrial settings. The market evolution and product development in the industry result from the combination of IoT technology with automation and energy-efficient solutions. The expansion of worldwide infrastructure makes Electrical & Electronics an essential foundation for technological advancement and economic growth.

The global value of wires and cables sector reached $228.4 billion in 2024; the sector serves as fundamental components for worldwide energy systems and telecommunications networks. The sector is expected to grow at a 4-5% CAGR due to the increasing investments in renewable energy grid development, 5G network deployment and data center construction. The wires and cables industry maintains its critical role in electricity distribution and communication networks and industrial connections which form the base of contemporary economic systems. The worldwide market demand for power transmission systems and smart grids continues to grow due to the increasing public & private investment worldwide.

The Telecommunication & Cellular Devices sector experiencing rapid expansion, with sales exceeding $1.5 trillion in 2024. The worldwide smartphone shipment 1.2 billion units while 5G subscription numbers are expected to exceed 6 billion during the next decade which enables industrial Internet of Things and advanced connectivity across the globe. The sector functions as a critical link between people and businesses while promoting digital access and enabling the expansion of data-driven service. Further, the growth is fueled due to the increasing need for faster network and mobile applications and cloud-based eco-systems.

Robotics technology has evolved beyond industrial automation to serve healthcare needs as well as support logistics operations. The worldwide robotics market reached nearly $50 billion in 2024, due to the increasing adoption in warehouse operations, surgical facilities and service-based businesses. These developments are driving electronics manufacturers to design specialized components and integrated systems to meet new market demands. The increasing advancement of AI technology with machine vision systems and sensor advancements enables robots to execute complex tasks with enhanced precision in adaptive operations. The combination of government & private funding in automation technology helps serves to solve labor shortages while enhancing operational efficiency and workplace safety standards.

The S&E Technology sector includes new technologies such as nanotechnology and advanced sensors and flexible electronics and AI-enabled hardware. The sector registered over $200 billion sales in 2024, highlighting the push toward automation, miniaturization, and next-generation devices.

Key Growth Drivers

The global Semiconductors and Electronics industry expansion results from the combination of industrial automation and robotics adoption, rising demand for consumer electronics, and electrification and EV adoption across the globe. These industry forces create evolving market demand patterns that reshape investment priorities and redefine competitive positions across various segments.

Industrial Automation and Robotics Adoption

The global semiconductors & electronics industry experiences growth because of rising industrial automation and robotics adoption in healthcare, manufacturing and consumer electronics sectors. The industrial robotics market will reach $44 billion during the 2032 due to the expanding automated manufacturing operations worldwide. Advanced fabs now use robotic wafer handling systems in more than 70% of their operations to enhance production yields and reduce contamination risks. The number of manufacturing robots used for electronics assembly has exceeded 580,000 units during 2024 while the industry continues its rapid automation process to boost manufacturing efficiency. The combination of AI with IoT and digital twins through automation technology produces faster and more resilient production systems that drive long-term business competitiveness and worldwide market expansion.

Rising Demand for Consumer Electronics

Consumer electronics stands as one of the fastest-growing sectors which demonstrates continuous expansion through revenue growth and technological advancement. The global consumer electronics market reached $1.2 trillion in 2024 due to of two major factors: the pandemic-fueled surge in home entertainment and the ongoing digital transformation that increased worldwide adoption of smart TVs and laptops and wearables and smartphones. Rising need for consumer electronics across the globe is one of the most powerful growth drivers for the global semiconductors & electronics industry.

However, the industry has also faced challenges from recent supply chain disruptions. Despite this, consumer electronics has remained resilient and continues to evolve. The expanding market has created new consumer behavior patterns and distribution methods. The market experiences accelerated growth because of emerging trends which include invisible AI systems in appliances and MicroLED and transparent displays in vehicles and smart furniture. The market trends demonstrate rising consumer interest in smart homes and connected devices and digital lifestyles which drives semiconductor & advanced material and next-generation electronics technology requirements thus sustaining the sector as a permanent growth driver for the industry.

Electrification and EV Adoption

The worldwide adoption of electric vehicles creates substantial market demand for semiconductors and electronic products. The electric vehicle market will reach 20 million units in 2025 while EVs will make up more than 25% of all car sales with first-quarter sales showing a 35% annual increase. The China leads the market, with EVs projected to account for 60% of total car sales in 2025, supported by govt incentives. In Europe, strict emissions regulation is expected to raise EV sales up to 25% of total car sales, accelerating the transition to zero-emission vehicles.

The increasing adoption of electric vehicles creates rising market requirements for semiconductors and electronic systems which include power electronics, battery management chips & sensors and AI-enabled control units. Further, the expansion of charging stations and smart grid connections creates additional requirements for sophisticated electronic systems. The expanding EV ecosystem creates direct market growth for global Semiconductors and Electronics industries while making electrification as a major industry growth factor.

Challenges & Restraints

The Semiconductors and Electronics industry encounter multiple major obstacles which affect its business expansion and market position. Supply chain disruptions, geopolitical tensions, rapid technological changes, and strict regulatory requirements are forcing companies to continuously adjust their strategies, investments, and operations to stay competitive.

Supply Chain Disruptions

The Semiconductors and Electronics industry face its biggest risk from supply chain disruptions. Fabrication is remains highly concentrated, with Taiwan alone making up 68% of global advanced-node capacity. This leaves the system open to geopolitical and natural shocks. The system's weakness was exposed by COVID-19 restrictions, the Russia and Ukraine conflict that cut 45 to 54% of the global neon supply, and rising trade tensions between the U.S. and China.

These disruptions have led to longer lead times, increased material costs, and production halt in the automotive and consumer electronics sectors. Beyond economic impacts, national security concerns are intensifying, as many nations remain dependent on imports for defense, communications, and infrastructure chips. To reduce risks, governments and companies are building domestic fabs, diversifying suppliers, and using advanced analytics. India, for example, has started 10 strategic projects including high-volume fabs, OSAT facilities, and 3D packaging units to improve resilience in a sector expected to grow at a rate of 14.6% CAGR in global fab construction through 2035.

High Capital & Infrastructure Requirements

The Semiconductors and Electronics industry face substantial barriers because of its high capital expenses and infrastructure needs. The operation of semiconductor fabrication facilities requires billions of dollars for construction and daily usage of substantial water and electricity resources. The deployment of 5G and fiber infrastructure by telecom companies need billions of dollars for their implementation. The production of wires and cables through copper-intensive manufacturing lines requires substantial financial investment for both production facilities, distribution centers and regulatory compliance systems. The implementation of robotics systems requires substantial financial outlays because industrial robots cost between tens of thousands to hundreds of thousands of dollars and businesses need to spend more on software acquisition, employee training and system integration.

The industry faces additional expenses because companies need to train skilled personnel who require multiple years of training to perform precision manufacturing and system management tasks. The implementation of sustainable practices has introduced new expenses because businesses must establish waste recycling facilities and develop responsible e-waste management systems. The combination of geopolitical risks forces companies to establish duplicate facilities across different regions for securing their supply chains. The industry requires substantial capital investment because of these factors which create entry barriers for new companies while forcing established businesses to handle rising operational expenses in a rapidly evolving market.

Opportunities

The Semiconductors and Electronics industry offers significant opportunities fueled by accelerating digital transformation, adoption of AI and IoT, and the global shift toward electrification. Advancements in chip design, power electronics, and semiconductor materials are enabling next-generation devices with higher efficiency and performance. Emerging markets such as electric vehicles, renewable energy systems, and 5G infrastructure continue to expand the industry's growth horizon, creating strong prospects for innovation and strategic partnerships.

Global Partnerships and Investments

Global partnerships and strategic investments are pivotal opportunities for the Semiconductors and Electronics industry. Between 2024 and 2032, investments in wafer fabrication capacity within the semiconductor industry are forecast to reach $2.3 trillion. This substantial investment underscores the industry's commitment to expanding production capabilities and meeting the growing demand for advanced semiconductor technologies.

Telecom companies are using mergers and acquisitions to build better infrastructure while improving their service delivery capabilities. The proposed $20 billion acquisition of Frontier Communications by Verizon aims to build out its fiber optic network and gain more customers. The robotics industry receives substantial funding from investors during this period. In 2024, robotics investments reached approximately $1.3 billion, indicating strong investor confidence in automation technologies. The AI robotics startup Figure achieved a $39 billion valuation after securing more than $1 billion in Series C funding which demonstrates rising market demand for AI robotics solutions.

The examples show how global partnerships and investments create extensive business opportunities which help companies enter new markets while sharing technological progress and building stronger market positions in the fast-changing Semiconductors and Electronics industry.

Sustainability & Circular Economy

The worldwide transition toward sustainability and circular economy operations will generate multiple billion-dollar business opportunities, with the green electronics market is expected to exceed $170 billion by 2030. The market demand for energy-efficient chips, recyclable consumer devices, low-carbon manufacturing and environmentally friendly data centers continues to grow, as companies respond to stricter ESG requirements already met by over 80% of large global firms publishing sustainability reports and growing consumer expectations. E-waste is becoming a critical driver, with volumes expected to reach 82 million metric tons by 2030, pushing leading players to invest in closed-loop supply chains and rare-earth recovery to secure resources. At the same time, industry giants like TSMC, Intel, and Samsung have all pledged net-zero operations by 2050, making carbon-neutral fabs, renewable energy adoption, and low-power design architectures a competitive edge. Early movers that embrace green electronics and circular models will not only meet compliance and build brand trust but also unlock higher margins, as the sustainable electronics segment is forecast to grow at a CAGR of 8-9% through 2030, shifting sustainability from a 'nice-to-have' to a market requirement.

Competitive Landscape

The market data indicates Samsung Apple and TSMC maintained their market leadership through 2024 because of rising semiconductor and electronic product sales. The market data shows NVIDIA achieved the most significant revenue growth by more than doubling its sales because of rising demand for AI and advanced computing solutions. The market competition and changing market conditions led to revenue decreases at Intel and Siemens. The companies Schneider Electric, ABB, Qualcomm and Prysmian Group achieved stable revenue growth through their efforts to expand their product lines and improve operational performance. The worldwide market leaders maintained their position through their ability to develop new technologies and expand their product range while showing resistance to economic challenges.

| Major Companies | 2024 | 2023 |

|---|---|---|

| Samsung | 145.8 | 116.9 |

| Apple | 94.9 | 89.4 |

| TSMC | 90.1 | 69.3 |

| NVIDIA | 60.9 | 26.9 |

| Intel | 53.1 | 54.2 |

| Schneider Electric | 41.2 | 38.8 |

| ABB | 33.2 | 32.3 |

| Qualcomm | 33.1 | 30.3 |

| Prysmian Group | 18.4 | 16.6 |

| Siemens | 17.7 | 21.2 |

Note: *Sources – Annual Reports | All figures are in USD Billion

Ready to Get Industry-Specific Insights?

Contact our industry consultants today to discuss your market research needs and discover actionable insights for your industry.