Global Building & Construction Industry Outlook, 2025

An in-depth analysis of key trends, market dynamics, and growth opportunities shaping the Global Building and Construction industry in 2025.

Explore High Growth Markets

Author: Vineet Pandey

Introduction of Building & Construction Industry

The building & construction industry functions as a base sector which creates the physical infrastructure of every nation. The industry generates substantial economic value globally but its essential value emerges from its domestic role which supports housing development, infrastructure construction and economic performance. The construction process starts with material procurement and design work followed by planning stages and site implementation before moving into extended asset management and modernization phases. The sector demonstrates how societies evolve their priorities through its role as a basic requirement and comfort and lifestyle driver.

Developing nations focuses on building fundamental requirements which include affordable housing and transportation networks and water supply systems and public facilities that support social advancement and economic expansion. In contrast, the developed nations focuses on sustainable development through smart city initiatives, energy-efficient buildings and urban renewal projects which improve resident quality of life. This dual perspective highlights how definitions of progress differ across geographies, yet all rely on the same core B&C industry.

The building and construction industry operates through four main sectors which include residential development and commercial construction and industrial facilities and large-scale infrastructure projects. The entire construction process depends on an interconnected system of products and services which includes construction materials, prefabricated structures, roofing solutions, insulation materials, safety barriers, highway signage and complex assets like marine & shipping infrastructure, ports and airports and railways and energy infrastructure. The industry covers both community-based civil construction and large-scale industrial and infrastructure development that determines national business performance.

Increasingly, technology is also becoming integral to the sector's future developments. The sector undergoes transformation through automation, IoT-enabled systems, digital twins and AI-based project management which improve design and execution and maintenance operations. The new technologies hold essential value for nations with developed or near-developed status because they focus on sustainable practices and maximum operational efficiency and extended asset life. So, the industry now builds more than physical structures because it focuses on developing intelligent and protected environments which respond to contemporary social requirements.

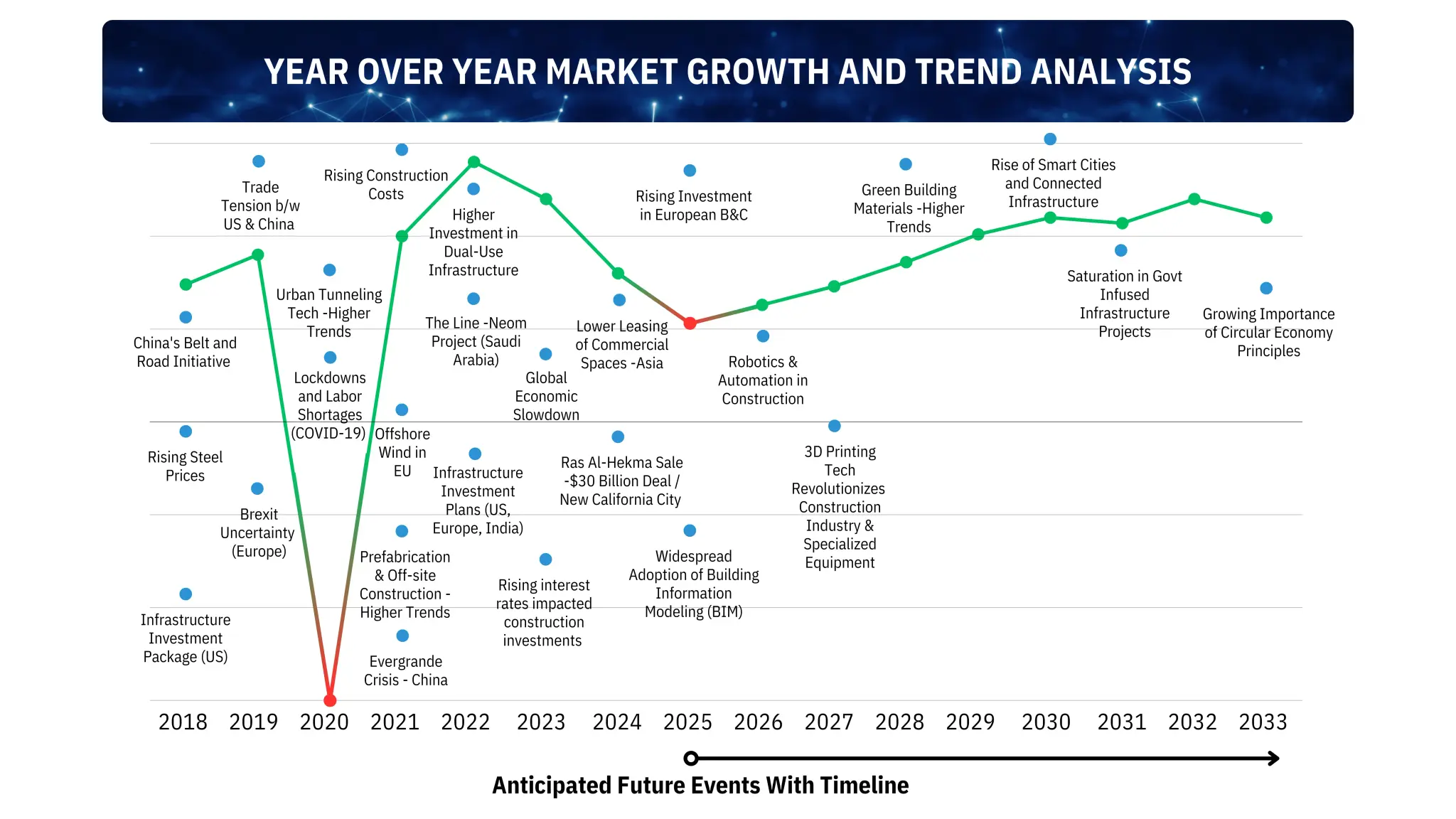

B&C-Infra industry growth pattern highlighting pandemic impact, sustainable construction trends, and market development milestones.

Global Building & Construction Market Size

The global building and construction market reached USD 14.3 trillion in 2024 to become one of the world's biggest economic sectors. The market includes three main segments which are residential and commercial construction and infrastructure & civil works. Residential construction makes up USD 4.3 trillion of the market while commercial construction reaches USD 1.1 trillion and infrastructure & civil construction amounts to USD 8.9 trillion.

The construction cost calculation depends on various factors because multiple supply chain elements and construction techniques influence the final market value. The residential construction sector used 1.3 billion metric tons of cement from the total 4.1 billion metric tons produced worldwide in 2024. The cement-based residential construction market value based on cement consumption amounts to USD 2.8 trillion because cement costs 5% to 6% of total construction expenses.

The market value of residential construction can also be estimated through steel rebar consumption data. The worldwide residential market consumed around 286 million tonnes of steel rebars in 2024 out of 357.6 million tonnes of global production and residential end users paid the price of around $761 per tonnes (40% to 45% higher than importer-level prices of USD 544 per tonne). As steel rebars typically account for 7% to 8% of residential construction costs, the implied market size again converges near USD 2.5 trillion.

The residential construction market size based on cement and steel analysis falls between USD 2.5 trillion and USD 2.8 trillion but this figure represents only a segment of worldwide residential construction. The worldwide residential building market consists of 65% cement & rebar-based structures and 35% of wood & other structures. Wooden houses specifically lumber based house are very common on North America and Eastern & Northern European regions while the rest is attributed to containerized, modular, and alternative construction formats. The residential sector's actual market size becomes clearer through material consumption analysis and structural method assessment and regional building practice evaluation which demonstrates its essential position in the USD 14.3 trillion building and construction industry.

How the Building & Construction Industry Works

The building and construction industry uses an organized process to convert initial design plans into operational completed assets. The majority of construction projects including commercial, industrial and infrastructure development follow a standardized sequence of steps which guarantees project feasibility, regulatory approvals and successful completion except for single-family residential homes.

The pre-feasibility study marks the first stage of project development because stakeholders & owners evaluate general project viability, select locations and identify potential risks. The feasibility phase follows the pre-feasibility study to validate project continuation through financial modelling, environmental impact assessments and resource planning. The design phase follows this sequence where architects, engineers and planners create complete blueprints, structural plans and technical specifications.

The execution process requires obtaining regulatory approvals which verify that the project meets zoning requirements, safety standards and environmental regulations. The construction process begins after approval acquisition through competitive bidding for EPC arrangements that include engineering, procurement and construction services. The project testing and inspection process leads to formal client acceptance during the commissioning phase.

These stages function as essential risk assessment points which protect both commercial and government-backed projects from excessive costs and prolonged timelines. The initial 3% of total project capital expenditure dedicated to pre-feasibility, feasibility studies and design work proves essential for risk reduction. The total project capital expenditure distribution shows that material and service procurements receive 40 to 55%; while construction work services including human resources, heavy machineries and logistics management receive 20 to 30%. Construction companies establish margin targets between 20% and 30% based on project size, construction techniques and market conditions.

The majority of contractors in current practice do not handle all project responsibilities on their own. Major construction projects go to lead contractors or a consortium of contractors, who divide specialized work such as structural construction, electrical systems, HVAC & safety systems and finishing tasks between vendors and sub-contractors. The distribution of costs between procurement and construction services also depends strongly on the selected construction approach. The deployment of modular construction methods by the main contractor leads to major changes in project duration and financial structure. The construction approach of modular building provides maximum benefits when project expenses, construction duration and site accessibility requirements are essential factors. The procurement lead time for prefabricated modules, structural components and materials directly affects the financial performance of the entire project.

The different sectors use distinct terminology to describe their project development stages. For instance, The oil & gas sector uses FEED (Front-End Engineering Design) as its initial stage before moving to EPC contracts. The real estate industry organizes its development stages through development cycles which start with land acquisition and entitlements before advancing to construction & sales. The stages of infrastructure projects such as railways and airports follow public-private partnership (PPP) frameworks through concession agreements and extended operational periods. The fundamental project development process maintains its consistency between different industries even though they use different terminology.

Key Segments of the Building & Construction Sector

Key Drivers

Urban Expansion, Sub-Urbanization, and Re-Urbanization

Government Spending on Public and Industrial Infrastructure

Industry Restraints & Challenges

Sluggish Private Investment Amid Global and Policy Uncertainties

Escalating Construction Costs and Supply Chain Disruptions

Opportunities

Green Buildings and Sustainable Construction

Industrial Infrastructure for the New Economy

Ready to Get Industry-Specific Insights?

Contact our industry consultants today to discuss your market research needs and discover actionable insights for your industry.