Industrial & Consumer Services Industry Outlook, 2025

An in-depth analysis of key trends, market dynamics, and growth opportunities shaping the Global Industrial and Consumer Services industry in 2025.

Explore High Growth Markets

Author: Vineet Pandey

Introduction to Industrial & Consumer Services (ICS) Industry

The Industrial & Consumer Services (ICS) industry operates as a fundamental economic sector which supports both business operations and daily consumer requirements. The industry generated $22.7 trillion in sales in 2024 and spans a wide range of services, including tourism and entertainment, B2C and C2C services, corporate solutions, automation, waste and water management, industrial services, and miscellaneous consumer services, thereby delivering fundamental support to businesses and consumers.

The ICS industry relied heavily on local market demand, manual work processes and conventional business approaches in its historical period. The operational reach and service personalization options remained limited while customer interaction depended on in-person contacts and paper-based systems. The industry has evolved through continuous technological advancement and global market integration and regulatory modernization which transformed service delivery models, operational frameworks and customer engagement strategies. The modern ICS industry now depends on digital platforms and data analysis together with automation systems to deliver services efficiently at scale while achieving rapid response times and enabling global expansion capabilities.

The sector undergoes three fundamental changes. First, the delivery of consumer services increasingly depends on digital platforms, mobile applications, and artificial intelligence-based personalization systems, allowing businesses to anticipate consumer needs and deliver tailored experiences at scale. Second, the adoption of automation and data-driven predictive maintenance solutions across corporate & industrial machinery, and other industrial processes leads to better operational efficiency, reduced downtime, and optimized resource management. Third, sustainability and resource management have emerged as strategic imperatives, with governments and enterprises investing in waste reduction, water conservation, and energy efficiency initiatives, reflecting a growing emphasis on environmental responsibility and long-term operational resilience.

Despite market changes, the ICS industry maintains its position and potential for growth. However, the industry faces three major obstacles which include workforce deficits, regulatory hurdles and supply chain breakdowns that may affect its ability to adapt and create strategic plans. The sector maintains its potential for substantial growth as it demonstrates flexibility and continues to implement new technologies. Our market projection indicates that, the ICS industry will expand to $48.5 trillion during the period from 2024 to 2035, due to the rising consumer needs, industrial development and technological innovation implementation.

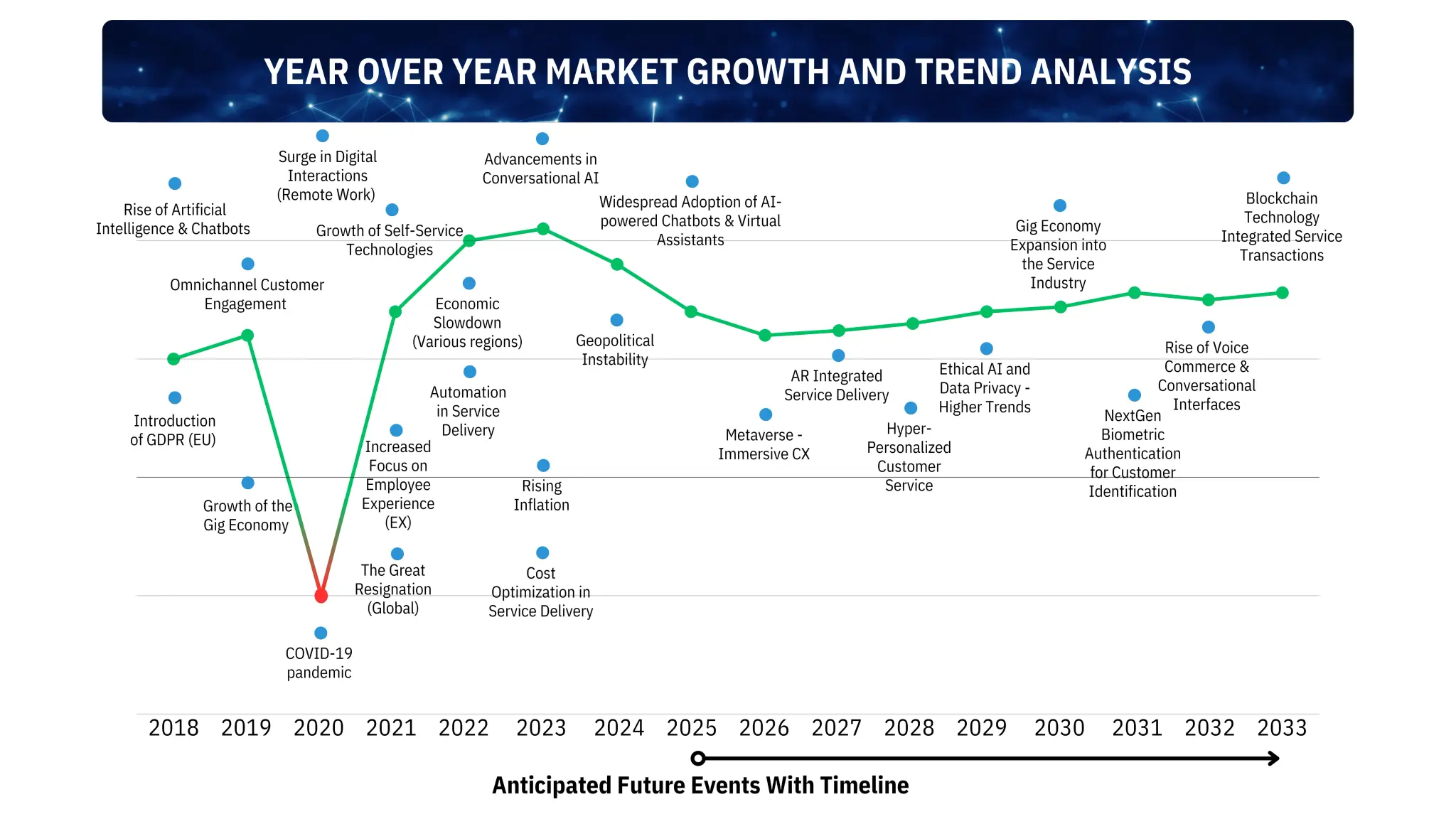

Industrial and consumer services industry growth pattern highlighting digital service adoption, pandemic disruptions, and market recovery.

Digital Evolution in the Global Industrial & Consumer Services Industry

The Industrial & Consumer Services (ICS) industry underwent a complete transformation from its past labor-based operations and local service model to a modern digital network which depends on data, artificial intelligence and automation. The previous service delivery model depended on human workers and physical facilities which restricted business expansion, made delivery times longer and limited customization options. Digital transformation over the past decade has revolutionized the entire ICS value chain by enabling new methods of value creation and delivery which resulted in worldwide market expansion, operational efficiency and increased business scale.

Historically, consumer service model operated through physical stores and human contact & local delivery systems which restricted business expansion, individualized service delivery and global market penetration, while, purchasing depended on physical access, and feedback loops were slow. The digital revolution transformed the business model into a worldwide data-focused network. E-commerce platforms like Amazon and Alibaba enable real-time shopping, seamless payments, and data-based inventory optimization, with the global e-commerce market is expected to reach USD 58.7 trillion in 2024. Food delivery services such as Uber Eats, Deliveroo, and Zomato have expanded through AI-driven recommendations and cloud kitchens. Likewise, travel and entertainment platforms like Booking.com, Netflix, and Disney+ use predictive analytics for personalized, on-demand experiences. These innovations enhance customer accessibility, loyalty programs, and subscription-based services, transforming consumer engagement worldwide.

Traditionally, industrial services operated through manual maintenance, isolated data systems data systems and reactive operations which restricted both visibility and operational efficiency. The combination of downtime with fragmented data and poor resource utilization created major obstacles for productivity and profitability. Today, the industrial sector experiences a transformation through AI, IoT, automation and cloud computing which brings predictive data-based efficiency and worldwide expansion capabilities. The implementation of predictive maintenance allows industries to predict equipment breakdowns while maximizing their resource utilization, supported by a $752.4 billion cloud computing market growing to $2.3 trillion by 2030. IoT-driven supply chains enhance visibility and agility, while automation and AI analytics boost precision and consistency, allowing industrial providers to scale globally with lower costs and higher operational resilience.

Collectively, these shifts mark a decisive transformation from human-reliant, fragmented systems to interconnected, intelligent networks that define modern service ecosystems. Digital evolution has not only modernized operations but has also expanded the industry’s global footprint, strengthened resilience, and positioned the ICS sector as a cornerstone of the digital economy.

Market Landscape and Economic Importance

The Industrial & Consumer Services (ICS) industry functions as an essential economic force which connects consumer markets, industrial operations and supporting business services across all geographic areas. The sector generated approximately $22.7 trillion in worldwide sales during 2024 which demonstrates its impact on global economic output and employment opportunities. The ICS industry spans multiple services including tourism & entertainment, B2C / C2C platforms, corporate services, automation solutions, waste & water management, industrial services, and miscellaneous service categories. The complex nature of the industry shows how it supports industrial productivity, consumer experience and operational efficiency throughout all economic sectors.

In North America, the ICS sector has a well-developed services ecosystem, solid infrastructure, and strong corporate demand. The United States contributes significantly through its leadership in B2C and C2C services, corporate outsourcing, logistics, and automation solutions. The market expansion in this region results from rising consumer incomes, business reliance on outsourcing, technological investment in automation and AI, and increasing demand for high-quality, customized services.

The European market holds 23% of the worldwide ICS market value. The region's strength lies in tourism, corporate services, and waste management, with governments actively promoting green solutions, digital platforms, and cross-border service integration. Germany, France, and the Netherlands are key contributors, implementing automation, cloud-based systems, and AI analytics to optimize resource management, improve service quality, and reduce operational costs. The European region maintains its competitive edge in the worldwide ICS market through its focus on sustainable operations and performance optimization.

The Asia-Pacific region leads all other markets in ICS growth as it holds 31% of the global market share. The region experiences rapid growth owing to its expanding middle class, rapid urbanization and accelerated adoption of digital services. Tourism, entertainment, and consumer services are rapidly expanding in China, India, Japan, and Southeast Asian economies, while industrial and automation services are experiencing robust growth alongside manufacturing and infrastructure development. As per Asian development bank, in 2024, Asia welcomed 323 million international tourists, marking a 21% increase from the previous year and recovering to 88% of pre-pandemic levels. The region has become a major hub in global ICS networks due to the government-backed initiatives, private funding which support the implementation of smart facility management systems and AI-based service platforms for scalable operations.

The ICS industry supports high-growth sectors which include logistics, industrial automation, facility management, travel, hospitality and entertainment across every geographic area. The ICS sector enhances productivity through operational optimization, data-driven decision support and customized consumer interactions which results in better industrial performance, industrial strength and societal well-being. Its strategic importance extends beyond service provision, establishing it as a vital enabler of innovation, economic resilience, and sustainable global growth.

Industry Segmentation of Industrial & Consumer Services

The global Industrial & Consumer Services (ICS) industry is a diverse and interconnected ecosystem that underpins economic activity, business operations, and consumer lifestyles. It comprises multiple sub-segments, including Tourism & Entertainment, B2C / C2C Services, Corporate Services, Automation, Waste & Water Management, Industrial Services, and Miscellaneous Services, each catering to distinct consumer and industrial needs. These segments collectively enable seamless service delivery, operational efficiency, and enhanced consumer experiences, forming the backbone of modern industrial and consumer ecosystems worldwide.

Includes hospitality services, travel, leisure activities and entertainment experience, serving as a critical driver of consumer engagement and discretionary spending. The market expansion results from higher consumer spending power, digital booking systems and increasing demand for personalized experiences. Expedia, Marriott, Disney and local tourism companies lead the market through their innovation in service and their ability to detect emerging consumer preferences. Technology, including mobile applications and AI-driven recommendation systems, enhances customer experiences and facilitates market expansion. This integration creates synergies with other consumer-driven ICS segments.

Includes e-commerce platforms, gig economy services, on-demand delivery, ride-sharing, and peer-to-peer marketplaces. The rapid digitalization of commerce and services has accelerated growth, with platforms such as Amazon, Alibaba, Uber, and Airbnb driving adoption, transforming consumer behavior, and establishing new standards for convenience, accessibility, and personalization. These services complement tourism and entertainment offerings by enabling seamless consumer engagement and supporting demand for integrated lifestyle experiences.

Encompass consulting, IT services, HR outsourcing, logistics support, and facility management. The sub-segment is driven by businesses seeking operational efficiency, digital transformation, and regulatory compliance. Leading providers like Accenture, Deloitte, and CBRE use new technologies, analytics, and professional skills to simplify processes, improve decision-making, and boost organizational performance. Corporate services connect closely with automation efforts; both aim to increase efficiency and lower operational complexity across industries.

This subsector provides tools & machinery installation/maintenance, infrastructure management and logistics and facility services. Expansion is driven by increasing industrial development, urban construction activities, rising use of predictive maintenance and IoT-based monitoring systems. The subsector connects established industrial operations with modern digital and automated solutions to achieve better efficiency, reliability and scalability across sectors.

Encompasses municipal, industrial and environmental services through waste collection, recycling, water treatment and resource efficiency programs. The combination of government and corporate funding for sustainability projects and circular economy initiatives leads to market expansion and technological breakthroughs. Major players such as Veolia, SUEZ, and Waste Management Inc. are advancing solutions that integrate technology, compliance, and environmental responsibility, reinforcing the ICS industry's contribution to sustainable development and operational resilience.

Focuses on industrial process automation, robotic process automation, AI integration, smart manufacturing solutions which have become essential for both industrial and service sectors. The implementation of automation systems leads to higher productivity levels, decreased errors and operational expenses which enables the development of scalable and consistent service delivery models. The fundamental role of automation enables other ICS segments to operate with enhanced efficiency and consistency which benefits corporate operations, industrial services and consumer platforms.

Includes specialized consumer and industrial services which include repair work, personal care, financial services and additional specialized solutions. The growth of these services depends on three main factors which include digital transformation adoption, consumer preference for convenient services and changing population demographics. The various miscellaneous services within this category support other ICS sub-segments through specialized service delivery which strengthens overall service networks and generates unified value for both consumer and industrial markets.

Key Growth Drivers

The global Industrial & Consumer Services (ICS) industry is experiencing accelerated transformation, driven by digital innovation, urbanization, and evolving consumer and industrial demands. The industry's expansion stems from four major forces: the adoption of digital platforms and automation, growing urban populations and rising consumer demand, increasing corporate outsourcing and efficiency mandates, and the expansion of cross-border connectivity and global service delivery. These dynamics are reshaping how services are delivered, managed, and scaled, redefining the global competitive landscape.

Digital Transformation and Automation

The ICS industry undergoes substantial transformation because of digital platforms together with artificial intelligence (AI) and robotic process automation (RPA). The industry adopts digital twins and predictive analytics and AI-driven customer interfaces as well as smart facility management systems for business operations. The implemented tools enhance operational performance while minimizing production stoppages and enabling customized customer interactions. Large businesses now use AI-powered chatbots and automated workflow platforms to manage 40% of their customer interactions, while predictive maintenance systems installed in industrial services facilities reduce equipment breakdowns by 20-25%. Digital solutions enable companies to operate more efficiently while providing scalable service delivery. The adoption of digital solutions enables ICS companies to fulfill increasing customer demands as well as industrial performance requirements across global markets.

Urbanization and Expanding Consumer Demand

The Asia-Pacific, Latin American and African regions experience rapid urban development, which leads to strong market requirements for tourism, hospitality services, personal care solutions and utility infrastructure. The urban population is expected reach 2.5 billion by 2030, thereby requiring expanded infrastructure services, on-demand to consumer platforms and lifestyle-oriented solutions. The growing middle class together with rising disposable income, is driving higher demand for premium services including boutique travel packages, luxury hospitality and subscription-based consumer products. The expanding urban areas and changing demographics enable digital booking systems, e-commerce, ride-sharing and gig-economy services to grow in tandem, creating numerous interconnected business opportunities across various ICS sectors.

Corporate Outsourcing and Efficiency Mandates

Businesses are increasingly outsourcing non-core services to focus on strategic objectives, driving growth in corporate services, logistics support, and facility management. Global corporate outsourcing spending is estimated at $1.2 trillion in 2024, reflecting a steady annual growth rate of 7-8%. Outsourcing enables enterprises to leverage specialized skills, technology platforms, and data-driven decision-making without expanding internal resources. Leading service providers implement AI, cloud-based ERP systems, and workflow automation to enhance operational efficiency, optimize costs, and ensure regulatory compliance, further reinforcing the scalability and resilience of the ICS ecosystem.

Global Connectivity and Cross-Border Opportunities

The expansion of e-commerce, travel, corporate services, and digital payment systems has enabled ICS companies to capitalize on cross-border opportunities. Improved logistics networks, integrated payment gateways, and digital platforms allow for seamless international service delivery, facilitating market penetration and global consumer engagement. For instance, cross-border e-commerce transactions are projected to surpass $4 trillion in 2025, while corporate services such as HR outsourcing and logistics management increasingly operate across multiple countries through cloud-based platforms. This interconnected global network enhances ICS companies' ability to scale operations efficiently, capture new markets, and respond dynamically to shifting consumer and industrial demands.

Challenges & Restraints

The Industrial & Consumer Services (ICS) industry is undergoing significant operational pressure due to workforce shortages, regulatory complexities, economic volatility, and supply chain disruptions. The industry faces multiple interconnected obstacles, including insufficient skilled personnel for AI-driven platforms and robotics, evolving environmental and labor compliance requirements, fluctuating consumer and corporate demand driven by macroeconomic uncertainty, and disruptions in the global supply of industrial equipment and technology systems. These challenges affect service quality, limit operational scalability, and constrain the ability of ICS providers to implement advanced digital solutions and expand into new markets.

Workforce Shortages

The Industrial & Consumer Services (ICS) industry heavily depends on technical experts and service-oriented staff to achieve operational excellence and maintain high service standards. The ongoing shortage of workers blocks business expansion as it affects three main areas: facility management, industrial maintenance and digital service operations. Organizations struggle to find skilled professional who can operate AI-based service platforms, robotics and predictive maintenance systems. The shortage of skilled workers not only prevents service delivery expansion but also hinder the implementation of modern technology, thereby restricting business growth and market competitiveness.

Regulatory Compliance

Compliance with environmental, labor, and safety regulations presents ongoing operational challenges for the ICS industry. Sectors such as waste management, water treatment, and industrial services are particularly affected, as evolving legal frameworks require substantial investments in monitoring systems, reporting protocols, and sustainable infrastructure. Non-compliance risks financial penalties, reputational damage, and operational interruptions, forcing companies to allocate resources to regulatory adherence rather than growth initiatives. The dynamic regulatory landscape across regions also increases complexity, requiring multinational operators to navigate differing standards in Europe, North America, and Asia-Pacific.

Economic Volatility

The ICS industry is highly sensitive to macroeconomic fluctuations, including inflation, currency instability, and slowdowns in economic growth. These factors directly influence consumer discretionary spending in tourism, entertainment, and B2C services, while also affecting corporate budgets for outsourced and industrial services. During periods of economic uncertainty, demand for premium services and long-term contracts can decline, disrupting revenue streams and profitability. Furthermore, volatile financial conditions increase operational costs, complicate investment planning, and require ICS providers to adopt flexible, risk-aware business models.

Supply Chain Pressures

Industrial and consumer services increasingly depend on complex global supply chains for technology systems, industrial equipment, and essential materials. These networks are vulnerable to disruptions from geopolitical conflicts, trade restrictions, and raw material shortages, which can delay service delivery, increase costs, and reduce operational efficiency. For example, delays in procurement of automation tools or IoT devices can cascade into reduced industrial productivity and lower service quality. Companies are therefore investing in supplier diversification, inventory management systems, and predictive analytics to enhance supply chain resilience, maintain continuity, and safeguard service reliability across global operations.

Opportunity

The Industrial & Consumer Services (ICS) industry is poised for significant opportunities, fueled by growing demand for sustainable solutions and automation-enabled efficiency. The sector's potential arises from expanding green and eco-friendly services, integration of AI and robotic process automation in operations, rising consumer and urban-centric service needs, and cross-border digital platforms that enable seamless international service delivery. These opportunities allow companies to enhance operational performance, enter new markets, and develop innovative service models, positioning sustainability and digitalization as key sources of competitive advantage.

Green and Sustainable Services

The rising focus on sustainability is unlocking new opportunity for green and sustainable services within the global industrial and consumer services landscape. The global market for eco-tourism, renewable energy services and circular economy solutions is expanding as governments, businesses and consumers are increasingly prioritizing eco-friendly solutions. The market demand for sustainable water and waste management solutions is rising as regulatory mandates and corporate ESG commitments drive large-scale investments in environmentally responsible service delivery. This transition is not only shaping operational strategies but also creating new business models where sustainability becomes both a compliance requirement and a competitive differentiator. As companies seek to decarbonize their operations, early movers in green services stand to gain substantial market share and long-term profitability.

Integration Of Automation in Industrial and Corporate Services

The implementation of automation systems in industrial operations and corporate services is fundamentally transforming operational structures. The combination of robotics, robotic process automation (RPA) and artificial intelligence (AI) systems are driving productivity growth, operational efficiency and cost reduction benefits for manufacturing, logistics and facility management operations. Organizations achieve better scalability and service quality through process automation of repetitive tasks which also decreases their need for human workers. The transformation enables businesses to boost their market position while redirecting personnel to advanced work that drives innovation at a faster pace. The increasing affordability of automation technology will drive worldwide adoption which will lead to fast growth in industrial and corporate service markets.

Competitive Landscape

The competitive landscape of the Global Industrial & Consumer Services (ICS) Industry in 2024 remained dynamic, with multiple leading companies maintaining their market positions through diverse service offerings and operational excellence. Amazon, Alibaba, and Deloitte continued to dominate the market due to their extensive global footprint, diversified portfolios, and strong customer base. Accenture PLC, Veolia, and Uber sustained stable growth by focusing on digital transformation, sustainability solutions, and innovative mobility services.

Real estate and hospitality service providers such as CBRE, Marriott International, Jones Lang LaSalle, Hilton, Expedia, and Airbnb demonstrated resilience and expansion by enhancing service offerings, adopting technology-driven platforms, and addressing evolving consumer preferences. These companies, along with other significant players not explicitly listed, collectively contribute to the highly competitive and fragmented nature of the ICS industry.

Overall, market leaders maintained their positions by leveraging technological innovation, expanding service lines, and navigating economic and regulatory challenges. At the same time, the presence of numerous other companies ensures intense competition, highlighting the importance of agility, operational efficiency, and customer-centric strategies across the global ICS sector.

| Major Companies | 2024 | 2023 |

|---|---|---|

| Amazon | 637.9 | 574.7 |

| Alibaba | 130.9 | 122.8 |

| Deloitte | 70.5 | 67.2 |

| Accenture | 64.9 | 64.1 |

| Veolia | 48.3 | 46.1 |

| Uber | 43.9 | 37.3 |

| CBRE | 35.7 | 31.9 |

| Marriott International | 25.1 | 23.7 |

| Jones Lang LaSalle | 23.4 | 20.8 |

| Hilton | 11.2 | 10.2 |

| Expedia | 13.6 | 12.8 |

| Airbnb | 11.1 | 9.9 |

Note: * Sources – Annual Reports | All figures are in USD Billion

Ready to Get Industry-Specific Insights?

Contact our industry consultants today to discuss your market research needs and discover actionable insights for your industry.