Global Food & Beverages Industry Outlook, 2025

An in-depth analysis of key trends, market dynamics, and growth opportunities shaping the Global Food and Beverage industry in 2025.

Explore High Growth Markets

Author: Debadatta Patel

Introduction of Food & Beverages Industry

The food and beverage (F&B) industry plays an important role in people's lives worldwide. It is one of the largest and most dynamic sectors in the global economy, covering everything from food production and distribution to retail and hospitality. At its broadest level, the industry includes food and beverages, agricultural and horticultural produce, food ingredients and additives, animal feeds, processing technologies, and foodservice. The industry is valued at $8.1 trillion in 2024 due to rising consumer demand, population growth, and expanding global trade in food products.

Historically, the food and beverage (F&B) industry has transformed from simple agricultural trade into one of the most complex and essential value chains in the world. This change shows how important this sector is for global economic stability and food security. The F&B industry mainly focuses on turning raw agricultural products into higher-value items like packaged foods, beverages, and foodservice options. This process depends on upstream activities such as farming, aquaculture, and animal feed production which are backed by improvements in processing technologies, ingredient innovations, and additives that ensure product quality, safety, and scalability. Due to its large scale and complexity, even small shifts in consumer preferences or production methods can have negative effects across global supply chains which influences agriculture, logistics, retail, and hospitality. The strong connections within the industry mean that a disruption in any one part can set off a chain reaction throughout the whole system.

In recent years, a number of factors have accelerated changes in the food and beverage value chain, including growing consumer demand for transparency, clean-label ingredients, and functional nutrition. According to a survey conducted by International Food Information Council, 58% of consumers worldwide prioritize quality in ingredients and products when making food and beverage purchases. This trend shows that purchasing decisions are more influenced by health and sustainability concerns rather than price alone. At the same time, digital and e-commerce channels are gaining popularity. Online and direct-to-consumer models are transforming distribution and brand engagement, compelling traditional players to change their market strategies.

Looking ahead, the food and beverage industry is set to grow steadily due to rising global incomes, urbanization, and changing consumer preferences for healthier, more convenient, and sustainable products. Innovation in product development, processing technologies, and packaging solutions will increasingly shape competitive advantage. At the same time, investment in digital platforms, improving supply chains, and sustainability efforts will support long-term industry strength. As companies respond to these trends, the sector will likely shift from focusing solely on volume to emphasizing differentiation, efficiency, and value creation throughout the value chain. The global food and beverage industry is expected to reach around $12.6 trillion by 2035, with a compound annual growth rate of 4.1% from 2025 to 2035. This growth path highlights the industry's crucial role in the global economy and its ability to meet the changing needs of consumers around the world.

Overall, these forecasts show that the industry has strong long-term growth potential, even though margins and growth rates may drop compared to the rapid early years. For all stakeholders, including producers, processors, retailers, and investors, the main challenge will be to balance scale with innovation, efficiency with sustainability, and global reach with local responsiveness.

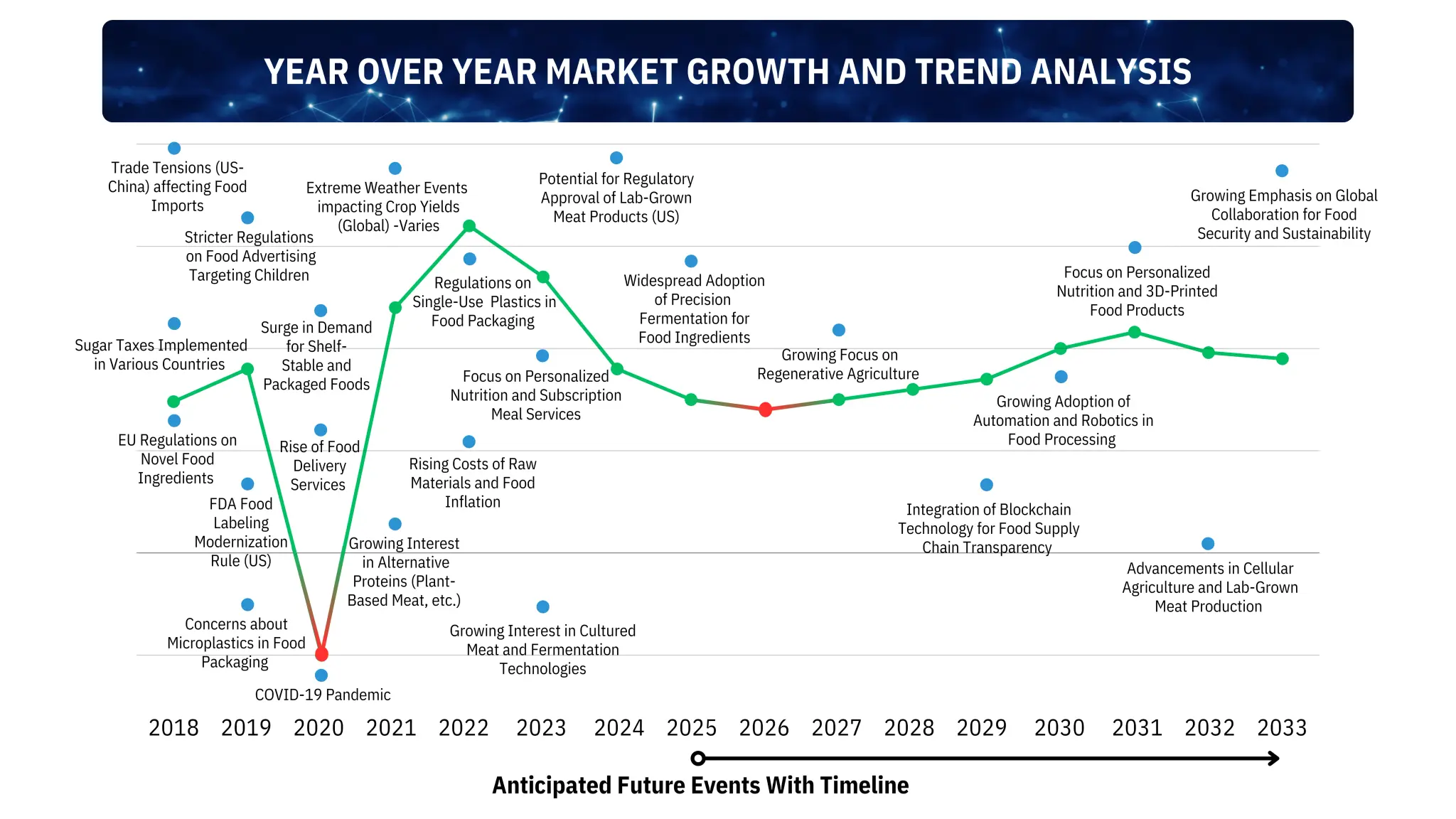

Food and beverage industry growth pattern highlighting pandemic impact, sustainability transition, and consumer behavior shifts

Market Landscape and Economic Importance

The food & beverage industry has a major role in economic growth deeply linked to, nutrition, health, and human well-being. It also plays an important role in global trade, with exports serving as a key driver of economic growth and employment. In 2024, global food exports reached approximately $1.9 trillion, with the United States, European Union, Brazil, and India acting as leading exporters of grains, processed foods, and beverages. These trade flows not only strengthen national economic resilience but also highlight the sector's integration into complex global supply chains, spanning agriculture, processing, packaging, logistics, and retail distribution.

As a fundamental driver of societal development, the industry contributes significantly to national income, employment generation, and international trade flows. For example, the food & beverage industry plays an important role in the US economy, accounting for about 5% of GDP, 10% of total US employment, and 10% of US consumers' disposable personal income. Additionally, the sector creates both direct and indirect employment across transportation, packaging, chemicals, and equipment manufacturing, generating a strong multiplier effect in the wider economy. In the United States, the food & beverage manufacturing industry generated nearly 2.1 Mn jobs in 2024, while its exports grew to from $57 billion in 2010 to $93 billion in 2024.

Beyond the US, the industry is equally important to global economic stability, as it acts as the backbone of agricultural value chains, manufacturing output, logistics, and retail distribution. In developing countries, the growing disposable incomes are further increasing the strategic importance of global food & beverage industry. The Asia-Pacific region has emerged as the fastest-growing consumer market, driven by increasing disposable incomes, rapid urbanization, and shifting dietary preferences. China, India, and ASEAN nations account for a large share of global food consumption growth, with India's food processing sector alone valued at nearly $160 billion, representing 7.7% of the country's manufacturing GVA. Further, countries such as Vietnam and Indonesia are also building strong export-oriented F&B sectors, while Japan and South Korea lead in advanced processing technologies. With expanding middle classes, Asia-Pacific is expected to dominate future growth in both packaged foods and beverages, including premium and health-focused categories.

Europe accounts for 25–27% of the global F&B market, combining rich traditions with a strong push for innovation. The region is a global leader in premium foods, alcoholic drinks, and dairy exports, with Germany, France, and the Netherlands at the forefront of exports, while Italy and Spain remain strong players in processed foods and beverages. Regulatory frameworks such as the EU Farm to Fork Strategy are reshaping supply chains toward climate-friendly and circular production models. At the same time, significant R&D investments in plant-based products and food technology are positioning Europe as a leader in sustainable consumption and production practices.

Consumer preferences are evolving rapidly, with increasing demand for premium, ethically sourced, and nutrient-rich products. Companies are responding by diversifying portfolios, launching functional and organic lines, and integrating sustainability into brand positioning. These developments highlight the industry's dual role as a critical economic sector and a strategic driver of innovation, consumer health, and environmental sustainability, positioning it for long-term growth and resilience.

Segmentation of Food & Beverages Industry

The food and beverages industry is a diverse ecosystem that includes food and drinks, agriculture, food ingredients, animal feeds, processing, technology, and various services. Although each sub-sectors serves a specific role, they are all connected through shared value chains, changing consumer preferences, and improving technologies. Together, these they show how the industry supports global economies while impacting daily life.

Packaged & Processed F&B represent the core of the industry, covering essential items like packaged foods, drinks, dairy, snacks, and baked goods. In 2024, this segment generated $6.6 trillion, driven by urban lifestyles, rising incomes, and better access to retail. Consumer preferences for health-focused choices, convenient packaging, and premium brands continue to push demand, demonstrating how lifestyle changes lead to market growth. This segment also includes food ingredients and additives that serve as an important link between raw produce and final products. Valued at $124 billion in 2024, these ingredients & additives improve taste, extend shelf life, and boost nutritional quality. The rising demand for natural flavors, plant-based proteins, and functional ingredients is changing this market, while regulations around clean labels and safety drive innovation. Biotechnology and sustainable sourcing are becoming more important, placing this segment at the intersection of science, consumer preferences, and competitiveness in fast-moving consumer goods.

Agriculture and horticulture produce are the foundation of the global food system, supplying crops, grains, fruits, vegetables, and pulses. Valued at $343 billion in 2024, this sub-sector reflects both population growth and the urgent need for food security. Farmers are increasingly adopting sustainable farming practices, while global trade connects producers to markets worldwide. Its essential role ensures a steady supply for downstream industries like fast-moving consumer goods, animal feeds, and food processing.

Animal feeds are vital for maintaining global supplies of meat, dairy, and fish, supporting protein consumption worldwide. This market, valued at $632 billion in 2024, represents the growing demand for protein-rich diets and the expansion of commercial livestock farming. Additionally, feed formulations now focus on probiotics, amino acids, and sustainable inputs, which not only enhance animal health but also lessen environmental impact. This segment is closely tied to both agricultural output and consumer demand, reinforcing the strength of the broader ecosystem.

F&B processing and technology ensure efficiency, safety, and innovation across the entire supply chain. Generating $365 billion in 2024, this segment includes tools & machinery, packaging, cold-chain logistics, and automation systems. Industry 4.0 applications, such as AI, robotics, and IoT-based traceability, are changing food production, storage, and delivery. By improving safety standards and optimizing resource use, this segment enhances both scalability and sustainability throughout the industry.

F&B miscellaneous covers emerging and related areas, including catering, online food delivery, functional beverages, and personalized nutrition. Valued at $142 billion in 2024, its growth is driven by lifestyle changes, digital platforms, and the demand for convenience. Additionally, products and services like wellness-oriented offerings, meal kits, and hybrid foodservice-retail formats illustrate how quickly consumer behavior is transforming this segment. Its dynamic nature also makes it a testing ground for innovation and new business models.

Together, these sub-segments create an integrated framework that defines the modern food and beverages industry. From farming to technology and from global supply chains to personalized consumer solutions, each part supports the others. This connected structure not only ensures resilience but also highlights future opportunities for investment, innovation, and sustainable growth.

Key Growth Drivers

The global food and beverages industry's growth is fueled by rising demand for transparency, health-focused innovation, agile local production, and data-driven personalization. These dynamics are reshaping sourcing and manufacturing practices, driving product and ingredient innovation, and redefining competitive strategies across categories from packaged foods and beverages to functional and specialty products.

Embedded Digital Traceability and Transparency-as-a-Service

More than 60% of global consumers are expected to want complete visibility into food origins and processing by 2030. This rising demand is leading to major investment in supply chains that use blockchain technology. Key companies such as Nestlé and Walmart have already expanded their blockchain tests to cover entire product lines, reducing recall response times from 7 days to just 2.2 seconds. This trend shows a broader shift: transparency is shifting from being a regulatory necessity to a value proposition for consumers, where traceability itself becomes a driver of willingness to pay and brand differentiation. As, such, companies that integrate transparency into their processes can build consumer trust and gain a competitive edge in the coming year.

Ingredient Functionality and Biodesign Innovation

Innovation in functional and precision fermentation ingredients is quickly changing the food and beverage landscape. Consumer interest in health-focused products drives this change, with over 52% of global consumers looking for foods that boost gut health, energy, or immunity. Companies such as Perfect Day and Geltor are leading the way in developing dairy proteins and collagen through microbial fermentation. They have cut costs by up to 70% compared to traditional extraction methods. This new focus moves attention from finished branded products to high-margin, licensed ingredient technologies. This innovation-driven driver is changing the industry's focus from mass-market branded products to high-value, licensed ingredient technologies. These technologies allow for differentiation, improve health alignment, and support sustainable production.

Hyper-Localization of Supply Chains Through Modular Production

Localized, modular production is transforming food and beverage supply chains. It focuses on being quick and responsive instead of relying on traditional large-scale centralization. The vertical farming market is expected to grow from USD 6.4 billion in 2024 to USD 26.6 billion by 2030 at a CAGR of 26% between 2025-2030. Companies using micro-factories and decentralized fermentation hubs are cutting logistics costs by 15 to 20% and customizing products to fit local preferences. For, example, PepsiCo's investment in modular snack production facilities in India and Africa has reduced lead times by 40% and improved SKU flexibility. These changes show a shift toward agile and regionally responsive production. This helps companies meet the rising consumer demand for fresher, localized, and culturally relevant products while strengthening the resilience of their supply chains.

Data-Driven Consumption Modelling and Precision Marketing

Advanced analytics and AI are becoming key drivers of efficiency and profit in the food and beverage sector. By 2027, more than 75% of the world's top food manufacturers are expected to use AI-driven analytics. Early adopters have reported increases in promotional ROI of 10 to 15% and cuts in spoilage costs of 5 to 8% with predictive modeling. For instance, Danone uses AI algorithms to analyze millions of flavor preference data points, allowing for real-time product launches in under six months, compared to the historical 18-month cycle. Data-driven consumption modeling turns raw consumer insights into practical strategies. This helps companies optimize their portfolios, reduce waste, and increase margins in an industry that typically operates with tight profit margins.

Challenges and Restraints

The global food and beverages industry faces challenges from the complexity and cost of implementing end-to-end traceability. It also deals with fragmented regional regulations, rigid supply chains, and issues in integrating different data for analysis. These factors slow innovation, increase operational costs, and limit the ability to respond quickly to changing consumer preferences in packaged foods, beverages, and specialty products.

Complexity and Cost of End-to-End Traceability Implementation

While digital traceability offers significant growth potential, putting in place end-to-end blockchain or IoT-enabled supply chains is both costly and complex. Estimates indicate that global food and beverage companies spend USD 2 to 5 per unit on advanced traceability systems. Costs increase sharply for multi-tier supplier networks. Integration with existing ERP systems, various suppliers, and specific regional regulations further slowdown adoption. As a result, companies face higher operational costs, longer ROI timelines, and potential delays in scaling transparency programs, especially mid-sized firms that do not have strong IT infrastructure. Consequently, while traceability can drive strategic growth, the challenges of implementation can limit the speed and reach of industry-wide adoption.

Regulatory Fragmentation Across Regions

F&B companies operate under a complex network of different safety, labeling, and ingredient regulations with over 70 food safety standards worldwide. This fragmentation raises compliance costs by 5 to 12 percent of annual revenues for multinational brands. It also makes product launches in various markets more difficult. The consequences include slower time to market, greater legal risks, and possible revenue loss if products do not pass local approvals or need expensive reformulations. Additionally, this regulatory complexity can limit the ability to innovate as new functional ingredients or fermentation-based proteins often need several approvals before they can be sold. In short, regulatory fragmentation serves as a major barrier to growth and innovation for food & beverages industry.

Supply Chain Rigidity and Scalability Challenges

Despite the theoretical benefits of modular and localized production, traditional food and beverage supply chains often remain inflexible and tied to large, centralized infrastructure. Transitioning to flexible micro-factories or decentralized models involves major upfront capital expenditures and changes to operations that many established manufacturers are not ready to make. Additionally, even when vertical farms or fermentation hubs are economically attractive, their relatively high per-unit costs compared to mass production can hinder rapid scaling. Limited access to infrastructure like cold chains and digital logistics platforms in emerging markets further restricts expansion. This supply chain rigidity can reduce flexibility, slow market entry, and limit the effectiveness of localization strategies, ultimately making it harder for companies to fully realize the benefits of on-demand or region-specific production.

Data Integration and Analytics Complexity

While AI-driven consumption modeling has significant potential, integrating diverse datasets, including POS, e-commerce, social media, and loyalty data, remains a major challenge. Nearly 60% of food and beverage firms say that data silos hinder predictive analytics and real-time decision-making. This challenge results in poor marketing effectiveness, mismatched inventory planning, and lost revenue opportunities, as companies find it hard to turn insights into operational action at scale. The problem is especially clear for global brands working in varied markets and digital ecosystems. This situation shows the need for strong data infrastructure and collaboration across different teams.

Key Opportunities

The global food and beverages industry is positioned for significant growth through personalized nutrition, plant-based alternatives, and sustainable packaging. These trends offer companies opportunities to differentiate their products, capture new market segments, and build stronger brand loyalty while meeting evolving consumer demands for health, sustainability, and convenience.

Personalized Nutrition and Functional Foods

Consumer demand for personalized nutrition that supports health is rising sharply. By 2030, more than 65% of global consumers are expected to look for food and beverage products tailored to their individual dietary needs, lifestyles, or health goals. This change is creating significant opportunities for companies to develop custom functional beverages, snacks, and meal kits by using digital health data and AI-driven formulations. Companies that successfully apply these strategies can achieve higher profit margins, build brand loyalty, and explore subscription-based models. This positions them as leaders in the future of nutrition.

Expansion of Plant-Based and Alternative Protein Products

The plant-based protein market is expected to grow from USD 35 billion in 2023 to over USD 85 billion by 2035, with a compound annual growth rate of 8.7%. While plant-based products are becoming more common, there is still untapped potential in regional formulations, hybrid proteins, and culturally tailored products. Food and beverage companies that take advantage of this gap can stand out through taste, nutrition, and sustainability. This can help them gain market share from both flexitarian and traditional consumers, especially in emerging markets. This offers a chance for growth beyond standard plant-based options.

Sustainable Packaging and Circular Economy Solutions

The sustainable packaging market for food and beverage is expected to reach USD 70 billion by 2030, growing at a rate of 7.5%. Innovations like biodegradable films, edible coatings, and reusable packaging meet regulatory requirements and rising expectations for sustainability from consumers. Using circular economy practices provides two benefits: it cuts waste management costs and boosts ESG credibility. Companies that effectively adopt sustainable packaging can achieve better positioning, improve brand differentiation, and attract more aware retail and institutional investors, matching growth with environmental responsibility.

AI-Enabled Product Innovation and Flavor Development

AI-driven recipe and flavor design is becoming a promising way to grow, especially for niche or ethnic-inspired product lines. Companies using AI algorithms can cut product development time from 18 months to under six months. They can also optimize formulas based on what consumers like, nutrient content, and cultural trends (IDC, Kearney). This ability allows for quicker innovation, lowers research and development costs, and helps companies respond better to new trends. Businesses that embrace AI-driven product innovation can gain a first-mover advantage, boost consumer engagement, and increase revenue, especially in high-margin or specialized areas.

Competitive Landscape

In 2024, the global food and beverages landscape demonstrated steady but uneven performance among major players. Cargill maintained its leadership position with substantial revenues of USD 160 billion, though lower than the previous year, reflecting normalization in commodity prices. ADM also experienced a revenue decline, largely due to reduced trading margins in grains and oilseeds. In contrast, JBS achieved strong revenue growth, supported by resilient demand for meat and protein products across North and Latin America. Anheuser-Busch InBev sustained stable revenues at around USD 59.7 billion, highlighting the resilience of the global beverage market despite inflationary pressures. Olam Group recorded a significant year-over-year increase to USD 56.1 billion, driven by diversification across food ingredients and agricultural supply chains.

Among consumer-focused companies, Mondelez International and Starbucks both demonstrated steady performance, posting revenues of USD 36.4 billion and USD 36.1 billion respectively, supported by strong brand portfolios and expansion in emerging markets. Kraft Heinz achieved moderate growth, while General Mills maintained relative stability at USD 19.8 billion, benefiting from demand for household packaged foods. Overall, the major global food and beverage manufacturers continued to display resilience through strategic cost management, portfolio diversification, and brand strength, despite headwinds from fluctuating commodity prices and macroeconomic uncertainty.

| Major Companies | 2024 | 2023 |

|---|---|---|

| Cargill | 160 | 177 |

| ADM | 85.5 | 93.9 |

| JBS | 77.1 | 72.9 |

| Anheuser-Busch InBev | 59.7 | 59.3 |

| Olam Group | 56.1 | 48.2 |

| Mondelez International | 36.4 | 36.0 |

| Starbucks | 36.1 | 35.9 |

| Kraft Heinz | 25.8 | 26.6 |

| General Mills | 19.8 | 20.0 |

Note: * Sources – Annual Reports | All figures are in USD Billion

Ready to Get Industry-Specific Insights?

Contact our industry consultants today to discuss your market research needs and discover actionable insights for your industry.